In this financial uncertainty period of the pandemic, saving has become extremely important to manage and manage your expenses properly.

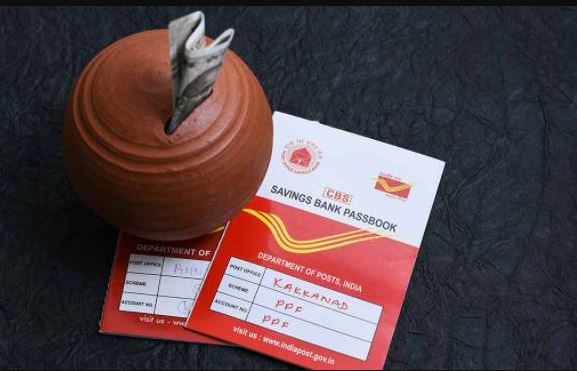

By investing your savings money properly, you can get good earnings and better returns from it. If you want to invest in low risk schemes with guaranteed return on your investment, then you can invest your money in Monthly Income Scheme (MIS) of Post Office.

This is a low-risk investment scheme, in which you earn interest every month. This post office scheme is for such persons who need money regularly after one time investment. Being a government scheme, this post office scheme is considered to be much better. Let us know about the important things related to this scheme.

investment amount

One can invest in this post office monthly income scheme in multiples of Rs.100. As a single individual, a maximum investment of up to Rs 4.5 lakh can be made under this post office scheme. If you invest jointly in this scheme, then up to 9 lakh rupees can be invested in this scheme. In case of joint holder, both the persons get equal share.

Who can open his account

In the Monthly Income Scheme (MIS) of the Post Office, any Indian person, who is above 18 years of age, can open his account. In this post office scheme, a joint account of not more than three adult persons can be opened. An account in this scheme can be opened in the name of a minor by his guardian. In this post office scheme, the limit of the account opened in the name of a minor is different from the limit of investment made by an individual.

interest accrued

In Dakkhar’s Monthly Income Scheme, you get interest at the rate of 6.6% per annum. In this scheme of Dakkhar, interest starts accruing as soon as one month is completed after opening the account, and interest continues to accrue till your account is not matured. If you do not claim the interest accrued every month, then you will not get the benefit of any additional interest on that interest amount.