NPS is a government investment scheme. First government, then from 2009 this scheme was opened for all categories of people. The special thing is that under NPS, employees can withdraw 60% of the total deposit amount at the time of retirement and the remaining 40% amount goes to the pension scheme.

New Delhi:Every man has to retire one day or the other. Whether it is a government job or a private job. Even now pension is available in some government jobs. In the rest, the government has implemented the Contributory Pension Scheme. Due to politics, now many governments have also restored the old pension scheme. It is possible that once again it will be implemented in the whole country. But this thing happened only to government employees. What will happen to those doing private jobs? What will happen to crores of people who work in the unorganized sector. What will happen to their social security? Governments have also been concerned about this. In response to this, NPS was implemented in 2004. We have talked about what is this NPS.

It has been informed that NPS is a government investment scheme. First government, then from 2009 this scheme was opened for all categories of people. The special thing is that under NPS, employees can withdraw 60% of the total deposit amount at the time of retirement and the remaining 40% amount goes to the pension scheme.

There are also advantages of NPS. Tax exemption is also given on the money deposited on it. Under section 80CCD(1) of the Income Tax Act, a tax deduction of 10% of gross income can be claimed. Under section 80CCE, this limit is 1.5 lakhs.

Explain that the minimum investment limit under the National Pension Scheme is Rs 6000. If the minimum limit is not invested, then the account is frozen and then a penalty of Rs 100 will also have to be paid to get the account defreezed.

You also have the right to get pension, complete this process for pension

To get a pension of Rs 10,000 in the National Pension System (National Pension System, NPS), the following procedure has to be followed.

First of all registration or say registration

To register in the National Pension System (NPS), one has to complete the registration process by visiting the website of any NPS pension fund. Required documents will need to be verified. These contain documents related to some important information like PAN card, Aadhaar card, address proof, etc.

Minimum qualification to get pension: The pension eligibility age limit of NPS has been kept at 60 years. It is also worth noting here that there should be at least 10 years of membership in NPS. That is, the person who subscribes at the age of 60 years will have to deposit money in NPS till the age of 70 years. Overall, assume that the age and membership criteria are met, then pension will be available.

Investment has to be done: To get pension in NPS it is necessary to invest. Regular investment has to be made in NPS account. The pension is decided on the basis of the age at which NPS is joined and the amount deposited. Information about this can be taken in advance.

Proper selection of pension scheme: The pension scheme can be selected on the basis of the expectation of a person and the amount of money he wants in the form of pension. A minimum fund amount has to be selected based on which the monthly pension is determined. Apart from this, permission is also given to change this minimum amount from time to time.

From when can pension be received- Any man can receive the amount of pension only after at least 60 years of age.

Now let’s discuss about how pension can be taken more than Rs 10000 per month. For this, how much will have to be invested and at what age one should start investing in the fund.

See first example..

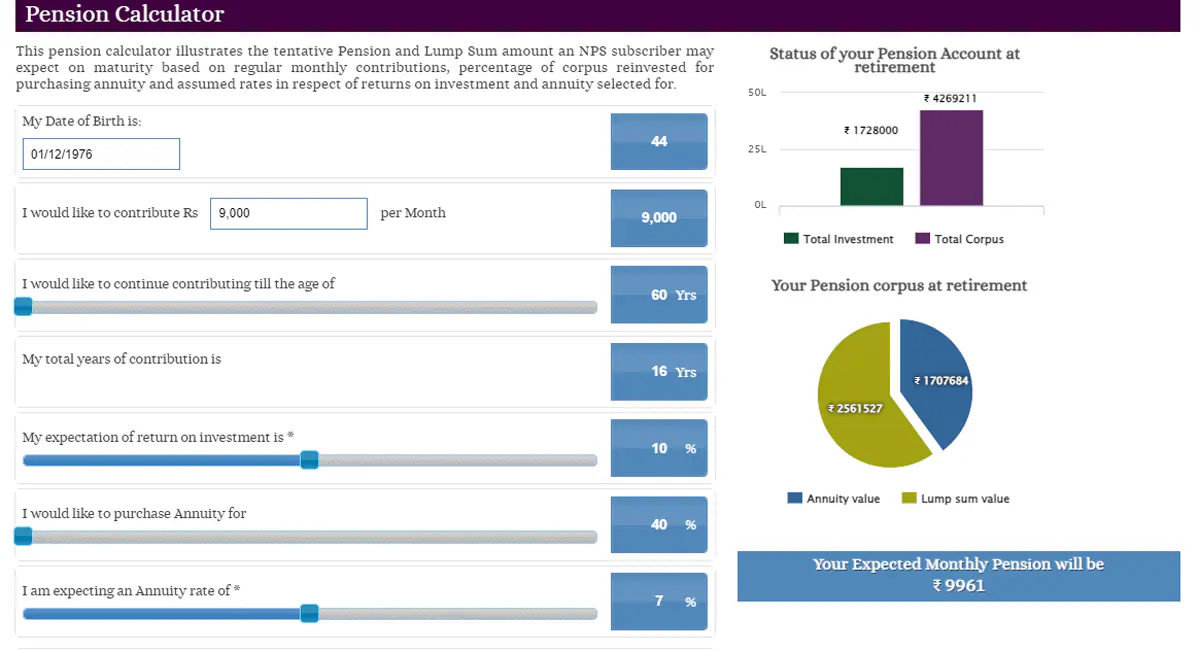

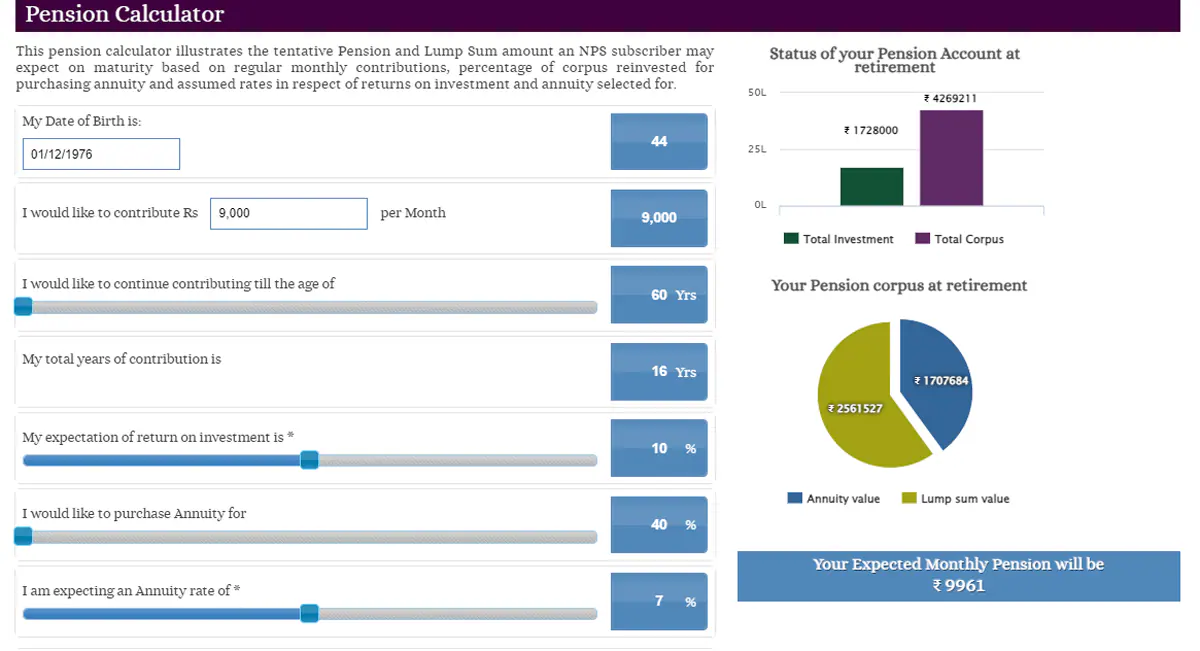

Here it is seen that the date of birth of the customer is December 1, 1976. Means 44 years according to NPS calculator. He wants to get a pension of 1000 pension after 60 years. So he will have to deposit at least Rs 9000 in the account every month. In this case, they will have contribution for 16 years. If the fund gets a return of 10 percent per annum, 40 percent of the fund goes to annuity and here the rate is seven percent, then what is the calculation made.

If deposited for 60 years, there will be an investment of Rs 17,28,000. On this the total corpus will be Rs 42,69,211. By doing this, the depositor will get a salary of Rs 9961 per month after retirement. This would have understood how to invest.

Second example,

Here we have taken the age of the pensioner as December 1, 1983. That is, today he is 40 years old. If he wants to take pension after 60 years, then for this he will have to pay 9000 rupees every month. According to this, this gentleman will deposit money in his pension fund for 20 years. According to the calculator given on the site of National Pension System Trust, if you get 10 percent annual return. Along with this, the necessary annuity of 40 percent is kept. If the rate of 7 percent annuity is available on this, then the deposit of the investor in the pension account on retirement will be Rs 21,60,000 and the total corpus fund will be Rs 68,91,273.

On this deposit, the scheme holder will get a pension of Rs 16080 per month every month. Means much more than 10000 rupees…

You can also use NPS calculator for yourself… Click here.