Post Office rule: Interest on Post Office Monthly Income Scheme (MIS), Senior Citizen Saving Scheme (SCSS), Post Office Fixed Deposit (Term Deposit) will not be paid in cash from April 1, 2022.

Interest will be paid only in the post office savings account or bank account of the account holder.

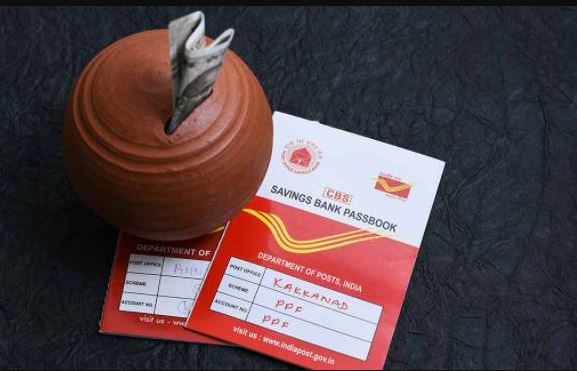

Post Office Rule: There is important news for the customers of the post office. The rules related to post office saving schemes have also changed. India Post has now changed the rule of interest on savings from the post office. If you are also a post office customer, then know the updates. Along with this, the post office has issued a circular and made a big announcement regarding interest payment.

New rules will be applicable from April 1

The post office has issued a circular saying, “From April 1, 2022, interest on Post Office Monthly Income Scheme (MIS), Senior Citizen Saving Scheme (SCSS), Post Office Fixed Deposit (Term Deposit) will not be paid in cash. Interest will be paid only in the post office savings account or bank account of the account holder. If an account holder has not linked his/her bank details with Senior Citizen Savings Scheme, Monthly Income Scheme or Term Deposit, then the total interest will be paid either by check or in his/her post office savings account. ‘

Must have link to savings account

It is worth noting that this rule will be applicable to all the customers of the post office whether you take the interest money monthly, quarterly or annually. Along with this, let us tell you that if a customer has not linked the savings account of the bank or post office with his savings scheme, then he may face problems from April 1. Therefore, to avoid any hassle, all the customers should link the post office scheme with the savings account before March 31, 2022.

Money will go to the account of various offices

Let us tell you that if you do not link both the accounts by March 31, then the interest received after April 1 will be deposited in the various office accounts of the post office. Once the amount of interest is deposited in the miscellaneous office account, it will be paid only through post office savings account or cheque. That is, it can become a cause of trouble for you.

In the post office, the interest money is paid monthly in the 5-year Monthly Income Scheme (MIS). Whereas for the 5-year Senior Citizen Saving Scheme (SCSS), the interest is paid quarterly. At the same time, interest on TD account is paid on an annual basis.

no interest on this amount

If Senior Citizen Saving Scheme, Monthly Income Scheme or Term Deposit is open in the post office, then no interest is available on the interest. This means that the interest money will be deposited in your account like dead money. So you can do some other work by withdrawing this capital.