RBI Monetary Policy: RBI has released the monetary policy. Let us tell you what effect it is going to have on your pocket.

RBI Monetary Policy: RBI has released its monetary policy. No change has been seen in the repo rate. That is, those who were hoping that the common citizen would get some relief on the EMI front, nothing like this happened.

RBI has maintained the old repo rate i.e. 6.5 percent. The stock market was swinging before the policy was introduced. Trade had crossed Rs 65,800. That means, it can be said that almost all the shares were trading above the green mark. However, after this news a decline is being seen in the stock market.

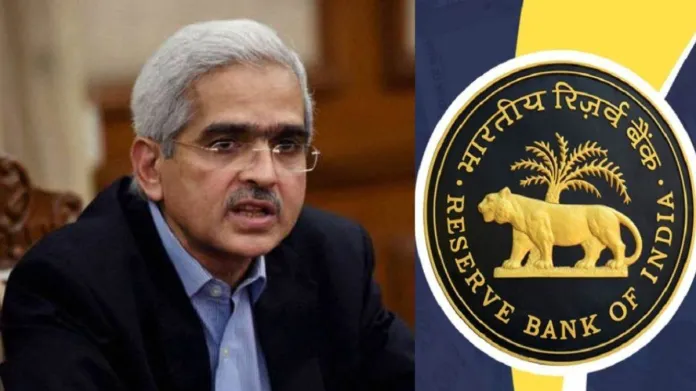

RBI’s Monetary Policy Committee decided to maintain the status quo, Repo Rate kept unchanged at 6.50%: RBI Governor Shaktikanta Das pic.twitter.com/IRfAjZ1Jra

— ANI (@ANI) October 6, 2023

Emphasis will be on reducing inflation

RBI Governor Shaktikanta Das has said that India’s growth has been very good. We want the inflation rate in India to remain at 4 percent. Every effort is being made for this. The RBI Governor further said that 5 out of 6 members of the MPC have accepted this plan.

However, Governor Shaktikanta Das also says that inflation may increase due to shortage of pulses. The inflation rate for the financial year 2024 may be 5.4 percent. There has been no change in GDP growth also. RBI has kept only 6.5 percent till now.

What is repo rate?

In this policy everyone keeps an eye on the repo rate. Let us tell you why this rate is so important. Actually, this is the rate at which loans are given to banks by RBI. If this rate is low then banks will take maximum loans from RBI and will further give loans to customers at cheaper interest rates.

The impact of this rate falls directly on our pockets. Therefore, monetary policy is issued by RBI after every two months. Before the policy, a committee of 6 members prepares its blueprint for 3 days.