RBI Monetary Policy Committee Meeting: The Reserve Bank of India (RBI) on Friday maintained the policy rate repo at 6.5 percent for the fourth consecutive time.

This means that there will be no change in the monthly installment (EMI) on various loans including house, vehicle. Along with this, the Central Bank has also maintained its economic growth rate estimate for the current financial year 2023-24 at 6.5 percent.

RBI Monetary Policy Committee Meeting: The Reserve Bank of India (RBI) on Friday maintained the policy rate repo at 6.5 percent for the fourth consecutive time. This means that there will be no change in the monthly installment (EMI) on various loans including house, vehicle. Along with this, the Central Bank has also maintained its economic growth rate estimate for the current financial year 2023-24 at 6.5 percent.

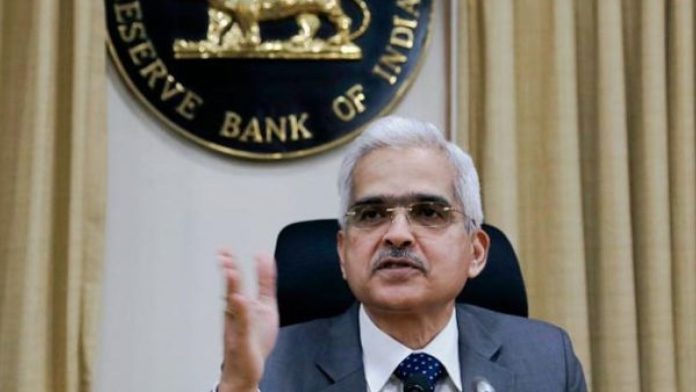

RBI’s Monetary Policy Committee decided to maintain the status quo, Repo Rate kept unchanged at 6.50%: RBI Governor Shaktikanta Das pic.twitter.com/IRfAjZ1Jra

— ANI (@ANI) October 6, 2023

Inflation will remain at 5.4 percent.

The consumer price index based inflation estimate for the current financial year has also been maintained at 5.4 percent. Giving information about the decision taken in the three-day meeting of the Monetary Policy Committee (MPC) that started on Wednesday, RBI Governor Shaktikanta Das said, ‘After considering the circumstances, all the six members of the MPC unanimously decided to keep the repo rate at 6.5. Decided to maintain the percentage.

Know what is Repo Rate

Repo is the interest rate at which commercial banks take loan from the central bank to meet their immediate needs. RBI uses it to control inflation. At the same time, the MPC has maintained its stance of withdrawing the liberal stance.

India has become the engine of economic growth for the world.

Das said that India has become the engine of economic growth for the world, but there is no scope for complacency. MPC will take necessary steps regarding inflation. RBI had not changed the repo rate even in the previous monetary policy review meetings of August, June and April.

Earlier, mainly to control inflation, the repo rate was increased by 2.50 percent a total of six times since May last year.