ATM Rules: For checking balance from bank ATM customer, you will have to pay a fee of Rs 5 and for checking balance from ATMs of other banks, you will have to pay Rs 8.

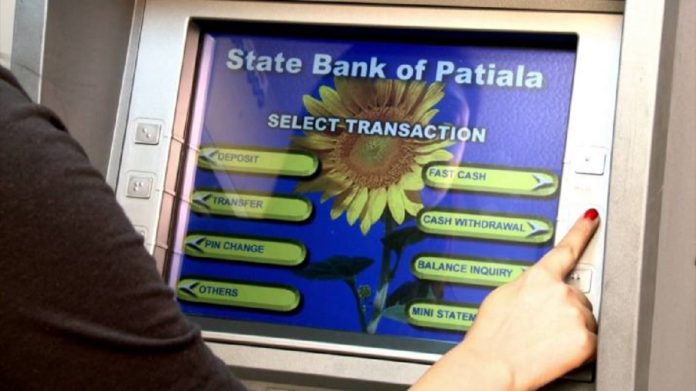

State Bank of India ATM Rules: If you are a State Bank of India customer, then this news is of your use. If the bank maintains a balance of up to Rs 1 lakh to its customers, you will not have to pay any charges on ATM transactions. On the other hand, if you withdraw money from any other bank’s ATM, then you do not have to pay any kind of fee for three transactions. At the same time, the limit for withdrawing money from Non-SBI ATM is different.

Depending on the base of your ATM i.e. SBI and Non-SBI ATM, you will have to pay a fee of Rs 5 to 20. On the other hand, if you withdraw more than the prescribed limit from the ATM, then you are charged a fee of up to Rs 10. On the other hand, if you pay more than the prescribed limit from other bank’s ATM, you will be given a charge of Rs 20.

It seems that this non-financial charge

, along with this, banks charge many different non-financial charges from their customers in addition to ATM charges. To check the balance from the bank ATM customer, you will have to pay a fee of Rs 5 and for checking the balance from the ATM of other banks, you will have to pay a fee of Rs 8. On the other hand, if you maintain a balance of more than Rs 1 lakh, then you will not have to pay any such fee. On the other hand, on International Balance Transaction, you will have to pay a fee of 3.5 percent of the total transaction amount and an additional Rs 100.